Designing Your Employee Benefits Plan

Now that you have a bit of the basic information sorted around when to start a benefits plan and how do you get started you can begin to look at your benefits plan design.

What should I include in my Employee Benefits Plan Design?

When prospective benefit clients approach me they talk about health and dental benefits and mention drugs, therapists, maybe vision and visits to the dentist – as these are often most valued by employees it is natural for employers to focus on this first. However, when “big” things happen to employees like a serious illness or disability how the company responds is a loud message about the corporate culture.

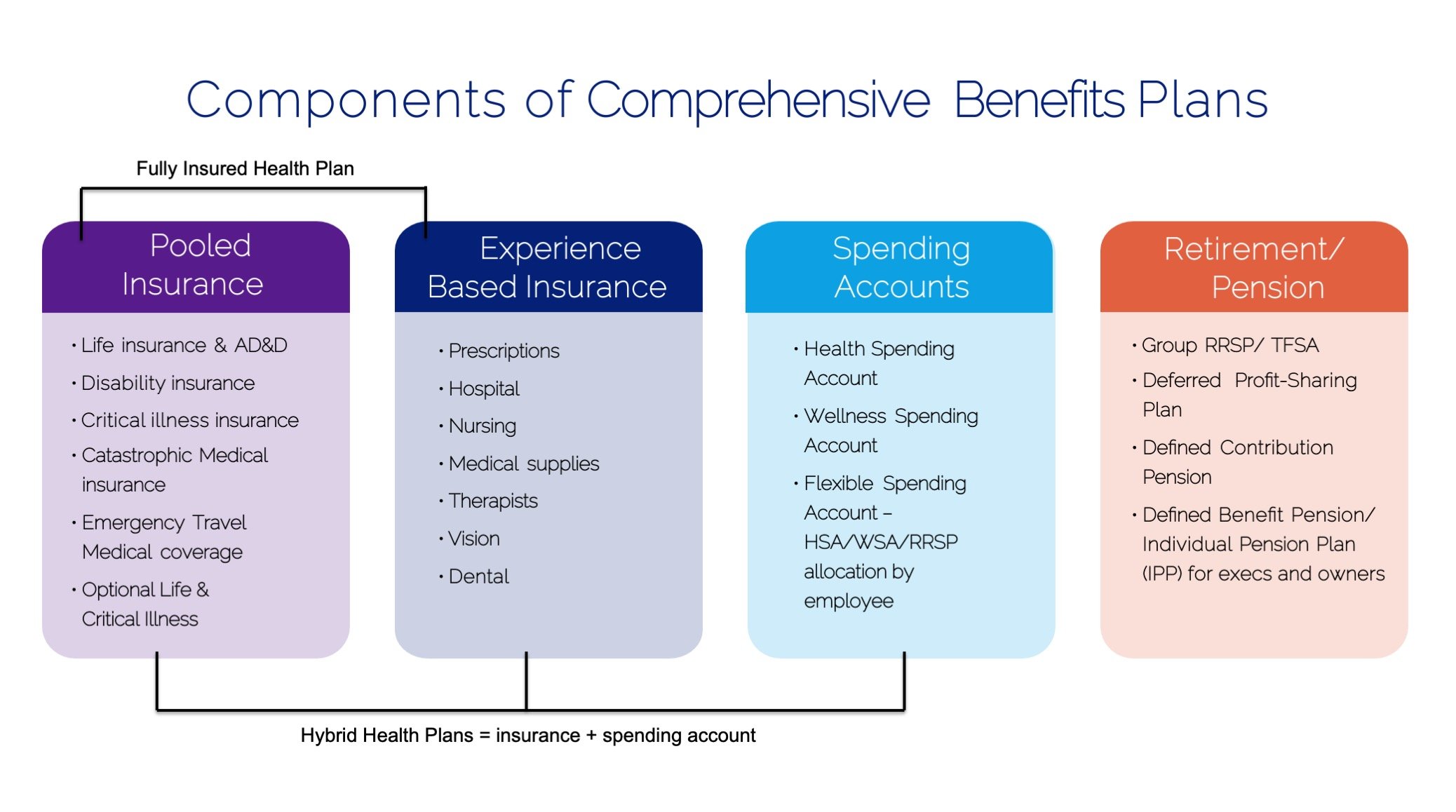

Rarely have they considered the true forms of insurance that can be included in an Benefits Plan design that will support an employee and their family when something catastrophic happens. There is insurance that provide employees with important income replacement and available funds if they are unable to work at their job. In fact, most Benefits Providers require that the Plan at least include Life Insurance and Accidental Death and Dismemberment Insurance.

Of course, focusing on what your employees ‘want’ and the services they will value is your first priority but what they may ‘need’ is important as well. Don’t short-change your Benefits Plan design by forgetting to consider other types of insurance like Disability, Critical Illness or Emergency Out of Country Medical Insurance. Crafting your policies for Health and Safety and Leaves of Absence like injury, illness and maternity/paternity leave may help you to consider what types of insurance are appropriate for your program.

A few things to think about as you begin:

Do you want all of your plan to be an insured plan with a list of services and annual maximums for each service OR do you want to give employees the spending power/power of choice by allocating the benefit budget into an Employee Spending Account - Health Spending Accounts and/or Wellness Spending Accounts?

Does your budget allow a combination of both? This hybrid option would achieve security and choice. Insure the high cost items like medication and travel and serious illness and use a spending account to accommodate employee lifestyle needs such as therapies, vision or orthodontics.

Is offering employees maximum choice the best approach for you? The concept of “bronze/silver and gold” and employees can choose the modest option or pay to get a higher level of coverage. This isn’t necessarily the best approach for a company new to benefits but may be a direction for growth. This type of Flex Benefit program is usually reserved for groups of 50+ employees. It requires a level of sophistication by the employer to manage the program and educate the team as well as maximum engagement by employees so they make the right choices.

There are several styles of plans you can choose from. Your Broker can help you navigate which would be the optimal balance of cost effectiveness and flexiblity for your organization. The chart below gives you a simplified look at the typical options available.

What to Consider when Designing Your Benefits Program

Don’t let the details overwhelm you. The table below helps to simplify the comparison but make sure your broker reviews all of these options with you.

Whatever your design preferences are it is always best to start safe. You can upscale and change your benefits program at any time as your budget or company growth dictates. A little upfront thinking and employee input will help define what is important and needs to be included in the group benefits design.

How would you answer the following questions (there are no right or wrong answers):

Do you want everyone to have the same benefits or is there a need to do something different for different groups in your company called Classes?

Do you want employees to contribute to the cost of the program? Upfront through payroll deductions or when they purchase something through the benefits program? When the employee portion of the Cost sharing through payroll deduction is too high it will influence employee’s perception of the value that the company is providing. Cost sharing at ‘time of purchase’ can positively curb purchasing habits and help manage employee usage and therefore assist in managing the Cost sustainability of the program.

Are you considering benefits as a perk and just a way to reduce employee out-of-pocket costs? A Health and Wellness spending accounts make it easy for employees see how you are helping them offset their personal expenses. Or do you also want to provide income replacement and stability if something catastrophic happens to your employee or possibly help them save money for their first home or build their financial nest egg? Offering Insurance or Retirement Savings will help you meet those goals. Group RRSP programs are easy to manage for employers but are often thought of as a benefit for only large companies. Don’t overlook this option because it is a alternate form of compensation that is easy for employees to see the value that the company is providing them and helps them meet their financial goals.

Do you have a sense of what employees value or are expecting? A simple survey may be helpful but be cautious. Once you ask employees their opinion they may expect you to deliver everything. Questions to potential hires about their benefit expectations may give you the needed insights on what is competitive and important.

Will you apply a wait period for benefits or not? ‘No wait period’ will increase cost but can ‘wow’ new hires.

Have you set a monthly or ‘per employee’ budget? Family employees cost at least 2 to 2.5 times of a single employee and may skew your ‘per employee’ budget.

Who Leads Your Benefits Program may help define what is the right design for you? A Certified Employee Benefits Specialist can be a great fit.

A Certified Employee Benefits Specialist broker will do a lot of the heavy lifting to manage your benefits and bring value to your employees but you also need to think about the administrative contribution the company needs to make to have a successful program.

How much effort can the company put into the benefits program, who on staff will take the lead and be the point person for your team ? Does this person have experience with benefits? How much support can your Certified Employee Benefits Specialist broker provide? Who will lead the program and how much time they have for Benefits Administration might dictate whether a traditional insured program might be easier to manage than a “highly flexible/maximum employee choice” model which requires more administration time and high employee engagement to manage their choices every year.

How to Look at a Benefit Program Quote

Just a note to remember: Take time to select a broker that you want to work with and can trust before you try and get quotes for your potential program. Benefit Providers/Insurers will not provide quotes to multiple brokers for the same company. It pays to ‘shop’ for your broker first and make that choice confidently so you don’t run into problems with your favourite broker being “closed” out of quotes.

Benefits break out into Pooled Insurance (pricing pooled with the insurers block of business) and Experience Rated (pricing based mostly on the company’s usage). Forms of Pooled Insurance includes insurance for Life, Disability, Critical Illness and Travel Medical. Health and Dental coverage is Experience Rated because the rates are impacted by the amount of claims from your team. When you look at a quote for benefits try to look for a program that gives you the most Premium dollars towards your health and dental coverage and the lower cost for Pooled Benefits because you will rarely use the Pooled insurance. You will want as much of your Benefits investment in Health and Dental premiums to cover the cost of your health and dental claims. Make sure that you have receive a presentation of quotes that shows a side by side comparison of all the components of the proposed program so you are comparing everything not just price. Ask your broker to explain how pricing and renewal work right in the beginning so you understand what you are buying now and how it may change over time.

Despite wanting to put a great program together, don’t stress too much over your initial decisions. While you don’t want to “take benefits” away from your employees, you can change your design at any time to respond to the needs of your group by adding important new features or removing what isn’t valued. You can also terminate your contract with your benefit provider at any time with a 30-day notice if it is not working for you. You can change your broker if that is not working with even less notice. And you can change one element of the program (broker and provider) without changing the other. You have lots of flexibility as the Employer to make sure you are getting everything you want.

Again, this information is not meant to overwhelm you but give you some tools to make better decisions around your group benefits design. It’s easy to move in the wrong direction if you don’t have all the information you need so make sure you and your broker work together to build a plan that’s right for you, your company, and your employees.